Margin Trading Guide for Dummies

You, as an investor, opt to allot capital with the hope of a future financial gain. If it’s your first time to engage in crypto margin trading, it’s vital to understand the things involved in it. Margin trading is a stirring and chancy way with risks, but you have a chance to gain great profits. Here’s a margin trading guide for you to help you succeed in cryptocurrency trading.What is Buying on Margin?Buying on margin is requesting money from a dealer to buy stock. In other words, it’s a loan that you can get from a company that buys and sells goods or assets for clients. The good thing about margin trading is that it enables you to purchase more stocks than you’d be able to normally.Moreover, you can keep your loan as long as you want, provided that you accomplish your commitment — you have to pay the interest on your loan. At first, the profits go to your dealer to recompense the loan until it’s wholly paid.

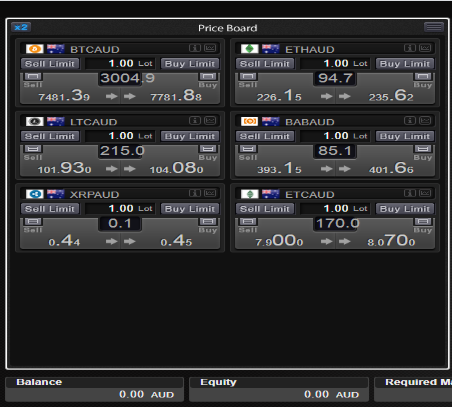

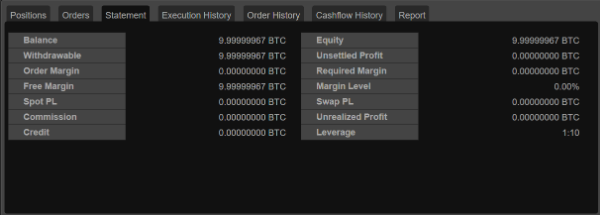

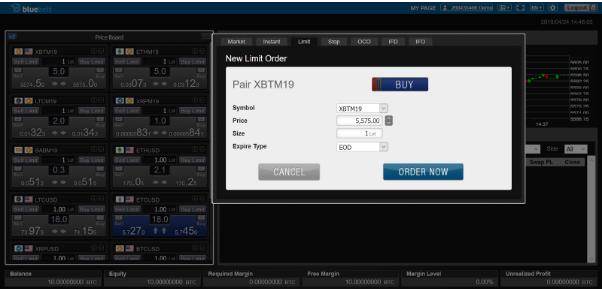

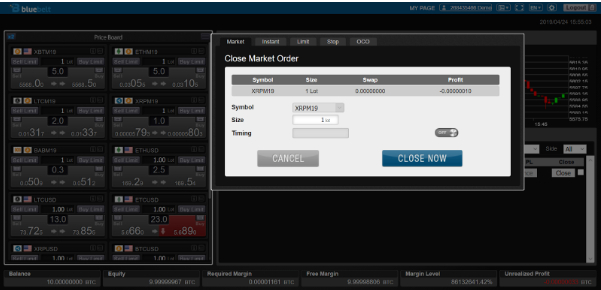

Image from Bluebelt

Example of a Buying PowerWhen you deposit $15,000 in your margin account which is 50 percent of the purchase price, your “buying power” has a value of $30,000. When you decide to purchase $10,000 worth of stock, your remaining buying power would be $20,000. You have ample cash to cover this deal because you haven’t tapped into your margin. A scenario where you’ll start borrowing money is when you opt to purchase securities amounting to more than $15,000.Take note: The buying power of a margin account swings daily. The value depends on the price fluctuation of the marginable securities in the account. That’s why it’s important to understand the inevitable volatility in the stock market.What is a Margin Call?This situation triggers if there’s a need to make the margin account reach the minimum maintenance margin when the account value drops below the trader’s required least value. A broker requests that a stakeholder deposits additional money or securities to meet the need. In other words, the investor is expected to sell some of the assets held to bring up the account.Good to know: Typically, maintenance margin percentage is at 25%. But, it can vary among brokers.How Does Margin Call Work?To make investments, one of the available options of an investor is to request a loan from a broker. This process is called Margin Call. By utilizing margin to purchase or trade securities, he pays for them through combined funds — his own funds and money that he borrowed from a trader. Here’s how to calculate the investor’s equity: Investor’s equity = market value of securities – loan from a broker.What Happens if the Margin Call is Not Met?A broker may close out any open positions to restore the minimum value of the account without your endorsement. Aside from this, you may be charged for a commission on the transactions. Any persistent losses during the process will be under your responsibility. Tip: An ideal way to dodge margin calls is to utilize shielding stop orders. In this way, you can limit losses from any equity positions. Also, you can maintain enough cash and securities in the account through stop orders.Leveraging Your BetYou are borrowing reserves to leverage your bet. Leveraging can also help you gain more profits, if you have an effective strategy, and if the odds are in your favor.Here’s an example: In 2:1 leverage, you can hold a position that is double the value of your trading account. For instance, if you had $10,000 in your trading account, you would be able to buy $20,000 worth of stock. This is possible through borrowing funds from the exchange or some other lenders. Reminder: Loan carries fees and interest that you need to settle at some time to avoid higher charges.

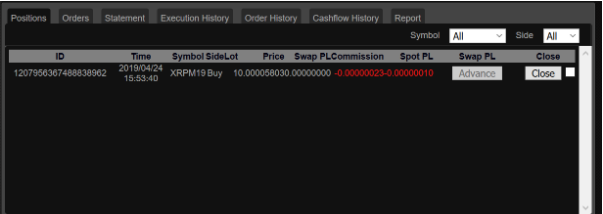

Example of a Buying PowerWhen you deposit $15,000 in your margin account which is 50 percent of the purchase price, your “buying power” has a value of $30,000. When you decide to purchase $10,000 worth of stock, your remaining buying power would be $20,000. You have ample cash to cover this deal because you haven’t tapped into your margin. A scenario where you’ll start borrowing money is when you opt to purchase securities amounting to more than $15,000.Take note: The buying power of a margin account swings daily. The value depends on the price fluctuation of the marginable securities in the account. That’s why it’s important to understand the inevitable volatility in the stock market.What is a Margin Call?This situation triggers if there’s a need to make the margin account reach the minimum maintenance margin when the account value drops below the trader’s required least value. A broker requests that a stakeholder deposits additional money or securities to meet the need. In other words, the investor is expected to sell some of the assets held to bring up the account.Good to know: Typically, maintenance margin percentage is at 25%. But, it can vary among brokers.How Does Margin Call Work?To make investments, one of the available options of an investor is to request a loan from a broker. This process is called Margin Call. By utilizing margin to purchase or trade securities, he pays for them through combined funds — his own funds and money that he borrowed from a trader. Here’s how to calculate the investor’s equity: Investor’s equity = market value of securities – loan from a broker.What Happens if the Margin Call is Not Met?A broker may close out any open positions to restore the minimum value of the account without your endorsement. Aside from this, you may be charged for a commission on the transactions. Any persistent losses during the process will be under your responsibility. Tip: An ideal way to dodge margin calls is to utilize shielding stop orders. In this way, you can limit losses from any equity positions. Also, you can maintain enough cash and securities in the account through stop orders.Leveraging Your BetYou are borrowing reserves to leverage your bet. Leveraging can also help you gain more profits, if you have an effective strategy, and if the odds are in your favor.Here’s an example: In 2:1 leverage, you can hold a position that is double the value of your trading account. For instance, if you had $10,000 in your trading account, you would be able to buy $20,000 worth of stock. This is possible through borrowing funds from the exchange or some other lenders. Reminder: Loan carries fees and interest that you need to settle at some time to avoid higher charges. Where to Margin Trade CryptocurrenciesSome of the big exchanges where you can find margin trading are Poloniex, Bitfinex, Kraken, Bitmex, and Bluebelt. So far, most of the dealers and investors are getting satisfaction through Bluebelt, a trusted cryptocurrency exchange platform based in Asia. Founded by financial professionals and talented ITs from Japan, it operates under global brands, especially the Bluebelt Exchange Group. Moreover, it has implemented a new margin trade and exchange strategy via Crypto-Fiat in December 2018. Currently, it has leverage 100x to help you maximize your profits.

Where to Margin Trade CryptocurrenciesSome of the big exchanges where you can find margin trading are Poloniex, Bitfinex, Kraken, Bitmex, and Bluebelt. So far, most of the dealers and investors are getting satisfaction through Bluebelt, a trusted cryptocurrency exchange platform based in Asia. Founded by financial professionals and talented ITs from Japan, it operates under global brands, especially the Bluebelt Exchange Group. Moreover, it has implemented a new margin trade and exchange strategy via Crypto-Fiat in December 2018. Currently, it has leverage 100x to help you maximize your profits.  How to Become Successful in Margin TradingThe secret to success in margin trading is to follow a slower approach. Take time to learn all the things that were discussed above. Before you register at an exchange and make a deposit, it’s critical to check their terms and conditions. Others are flexible, but there are some exchanges that have strict criteria in allowing margin trading.Moving forward, once you become aware of the technical analysis of price action, you can then develop a margin trading tactic. Soon, you’ll be an experienced trader with a strong personality who can avoid margin call and surpass the inevitable volatility.

How to Become Successful in Margin TradingThe secret to success in margin trading is to follow a slower approach. Take time to learn all the things that were discussed above. Before you register at an exchange and make a deposit, it’s critical to check their terms and conditions. Others are flexible, but there are some exchanges that have strict criteria in allowing margin trading.Moving forward, once you become aware of the technical analysis of price action, you can then develop a margin trading tactic. Soon, you’ll be an experienced trader with a strong personality who can avoid margin call and surpass the inevitable volatility.

Image from Bluebelt