FOUR Simple Signs of a Trustworthy Coin Project

Four Simple Indicators of a Trustworthy Coin Project

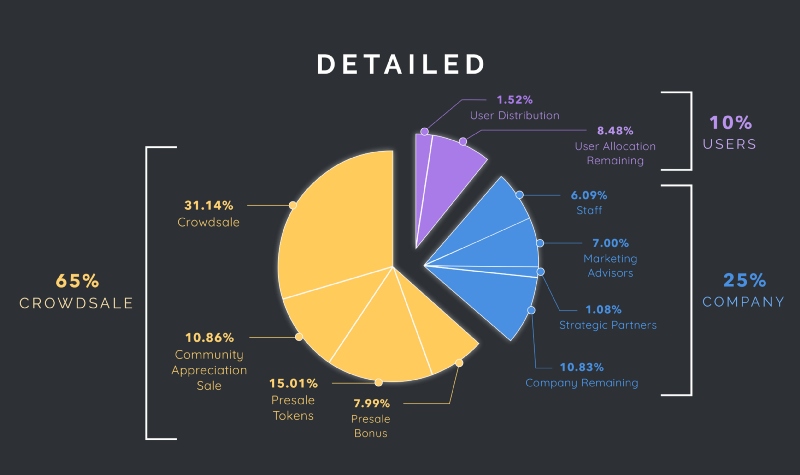

Image from Crypto BriefingUnlike in the traditional markets, coin projects are expected to keep only a small percent of the token supply for themselves. Majority of it is expected to be sold in the public token sale.A certain chunk of the tokens is also sold at a discount to private wholesale buyers during the private sale and wealthier individual buyers during the presale.This is done to prevent a single party from selling massive amounts of tokens all at once. Unlike in traditional markets, there are no lockup periods or circuit breakers that stop wholesale investors from mass-selling cryptocurrencies. That’s what happens in illiquid, unregulated markets. Therefore, when you notice that there’s a small amount to be sold during the public token sale, stay away from the project.The worst kinds of scams like this are pump-and-dump schemes where whales and influencers hype up a token so that people buy the small circulating supply, then sell more than half the supply on the market. This pushes the price so terribly down (lower than the price the victims bought) that the price never breaks highs ever again.Here is a sample of a good token supply distribution: 60% Public Sale, 20 Presale, 10% Private Sale, 5% Airdrop Rewards, 5% Founding Team. As you notice, more than half of the supply is distributed publicly at the same price. The collective majority has to act unanimously to even have a chance to manipulate price, which is by itself is already hard to do especially if the collective majority are hardcore followers of the coin.ConclusionIt is very easy to spot which coin projects are worth your trust, especially when you can recognize which things actually matter above all else. Marketing and community, strong team, sensible token distribution, and real use are four of the fundamental requirements of any good cryptocurrency project. There other signs of good projects but they are less easy to determine if you are not that experienced in crypto.One piece of advice we can give our readers is to trust your reasoning: If something is too good to be true, it probably is. There is no truly riskless investment, and crypto investments are no exception.

Image from Crypto BriefingUnlike in the traditional markets, coin projects are expected to keep only a small percent of the token supply for themselves. Majority of it is expected to be sold in the public token sale.A certain chunk of the tokens is also sold at a discount to private wholesale buyers during the private sale and wealthier individual buyers during the presale.This is done to prevent a single party from selling massive amounts of tokens all at once. Unlike in traditional markets, there are no lockup periods or circuit breakers that stop wholesale investors from mass-selling cryptocurrencies. That’s what happens in illiquid, unregulated markets. Therefore, when you notice that there’s a small amount to be sold during the public token sale, stay away from the project.The worst kinds of scams like this are pump-and-dump schemes where whales and influencers hype up a token so that people buy the small circulating supply, then sell more than half the supply on the market. This pushes the price so terribly down (lower than the price the victims bought) that the price never breaks highs ever again.Here is a sample of a good token supply distribution: 60% Public Sale, 20 Presale, 10% Private Sale, 5% Airdrop Rewards, 5% Founding Team. As you notice, more than half of the supply is distributed publicly at the same price. The collective majority has to act unanimously to even have a chance to manipulate price, which is by itself is already hard to do especially if the collective majority are hardcore followers of the coin.ConclusionIt is very easy to spot which coin projects are worth your trust, especially when you can recognize which things actually matter above all else. Marketing and community, strong team, sensible token distribution, and real use are four of the fundamental requirements of any good cryptocurrency project. There other signs of good projects but they are less easy to determine if you are not that experienced in crypto.One piece of advice we can give our readers is to trust your reasoning: If something is too good to be true, it probably is. There is no truly riskless investment, and crypto investments are no exception.