Everything A Beginner Needs to Know Before Margin Trading

What is Margin Trading? Margin trading is the act of trading your own funds (margin requirement) plus funds borrowed (margin) from a lender (broker). In traditional markets, institutional traders commonly use this to hedge their positions and offset the losses by making corresponding opposite positions.The traditional markets are no strangers to margin trading for it has been around ever since the futures and commodity markets started flourishing. If you are aware of forex trading, especially on the MetaTrader platform, it actually is just fiat-to-fiat margin trading.Margin trading is popular in more experienced crypto trader communities, which is not surprising. After all, it takes skill and nerve to navigate through bear markets and illiquidity. Why Do Margin Trading?To retail traders, the “leverage” feature is enough for it to be useful. Actually, there are only two real reasons for anyone to do margin trading.- You don’t have enough funds to buy a specific amount of assets.

- You want to maximize your potential profits.

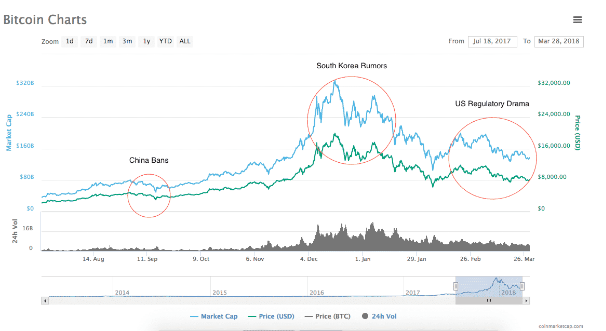

However, be reminded that margin trading is a double-edged sword. As it magnifies potential profits, it also magnifies potential losses. Crypto Market vs. Forex MarketWhile both are decentralized, unregulated markets, the forex market trumps the crypto market in terms of volume. The forex market boasts a whopping $5 trillion daily volume while the crypto market offers only around $45 billion trading volume, with BTC being half of all that volume.Compared to the forex market, the crypto market is a lot less liquid and a lot more volatile. Many crypto traders prefer crypto trading because of the massive price movements caused by its own illiquidity.Due to illiquidity and volatility, short-term trades are more reasonable than long-term ones in the crypto market. Swing trading may work in the forex market but it may cause too much damage to a crypto margin trader’s account if the risk is not properly managed.One advantage of the crypto market over the forex market is weekend trading. Since crypto does not rely on banks, crypto trading goes on even when banks are off during weekends. Factors that Affect the Price of Cryptocurrency Crypto market newbies are common victims of massive price corrections and price breakouts after consolidations. After much heartbreaks, traders eventually look for factors that affect crypto price movements to make sure they don’t fall victim to market moves anymore.Basic economics says supply and demand are the fundamental factors that move price. That is true, though that explanation is a bit general.Here are some specific factors that cause major price movements in the crypto market.FearThe acronyms FOMO and FUD are notorious in the crypto market due to its ability to cause huge market swings in very short periods. FOMO is the fear of missing out while FUD means fear, uncertainty, and doubt.Fear is one of the most primal emotions of human beings. We are naturally risk-averse, so we tend to act without much thought at the first indication of danger. Market influencers and thought leaders use fear mongering to influence a majority of crypto traders and investors to make identical moves.When they need the price to go up, they disseminate information that tells people that price is about to go up and the slow ones will be left eating dust.When they need the price to go down, they spread rumors and secrets that will make the price go down.The truth is the rumors and hearsays are sometimes the actual causes of the price moves. Dominance of Major CryptocurrenciesBitcoin and Ether are the most used cryptocurrencies in the world. In many exchanges, you can only buy altcoins using BTC or ETH. Many tokens are also built on the Ethereum platform. When BTC or ETH prices make moves, it is inevitable that altcoin prices go down as well. This price correlation is very evident on the daily charts. The fact that BTC and ETH comprise more than half of the crypto market volume empowers this correlation.Since BTC and ETH act as gateways to altcoins, lower demand for BTC and ETH lead to lower demand for altcoins. Technological advancementNew platforms, technology improvements, new tech partnerships, and deployment of a working product in the crypto industry can induce steadier price increase.However, none of these can guarantee a price increase because multiple factors work side by side to influence the price. Legal and Political FactorsLegal crackdown and rejection of adoption by traditional institutions like governments and regulatory bodies can influence the crypto price decrease. Crypto is a new technology that will naturally grow through adoption, just like any other product or service. However, institutions are there to steer the course of human activity to what it thinks is the right direction.Investors look forward to the promise of growth. That’s why they invest in the first place. If entities as powerful as governments and regulatory bodies prevent its natural growth, investors lose the reason to keep their investments. They begin selling their investments and retrieve whatever money they can.However, the opposite can massively influence crypto price increase. Since governments and regulatory bodies are the big obstacle crypto adoption faces, their acceptance will usher in new possibilities, prompting people to buy more crypto. What are the Risks of Crypto Margin TradingMargin trading is a fundamentally risky method of trading. Potential profits come with potential losses. That means leveraged potential profits come with leveraged potential losses as well, and your own funds will be the one taking those extra losses. Margin FeeIn the world of finance, borrowed money doesn’t come free. It has to be paid back with interest. If you are a day trader this may not be a concern, but if your trades take weeks or more, you can expect to pay between 5% and 10% interest on borrowed money. Margin CallNormally, brokers set a Maintenance Margin requirement (25% of total asset value on the margin account in traditional markets). When your balance below this due to price going against your way, the broker, would either of the two things:- Start liquidating your assets to get its money back.

- Ask the funds from you.

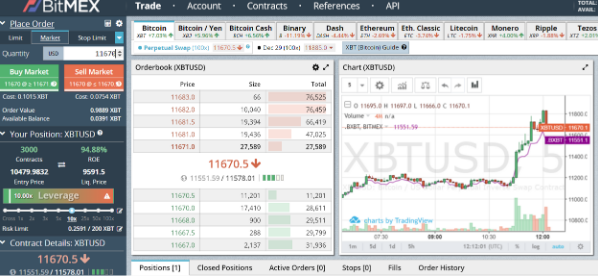

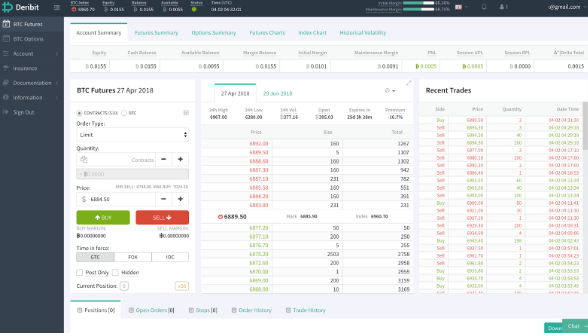

This action is called “margin call”. When you deposit more funds into your margin account, the margin call will be offset. Can You Be Rich in Crypto Margin Trading? Just like any other investment and trading methods, crypto margin trading can potentially make you rich. It can also wipe out all your funds and drown you in debt.The key to a successful trading career is to develop a system that has a positive long term performance and follow it consistently. It does not matter whether you use a robot or you manually trade, as long as the system works.An effective system has fixed parameters for taking profit and stopping losses. Without those two, trading is without any limit, making it inconsistent and therefore closer to gambling than real strategic trading. Common Terms Used in Margin Trading Here are some of the most common and most important terms that will help you understand margin trading more. They may be simple but knowing them by heart can save you from a lot of unnecessary trouble.Margin – The amount of money you will borrow from a broker to fully fund your margin accountMargin Account – The account you use to buyLeverage – The use of borrowed funds (margin) to either have enough funds to buy a certain amount of the asset or to increase potential profit and loss. Short Selling – Borrowing an asset form a broker and selling it to the market, buying it back ideally at a lower price, then returning it to the broker with the intent of making a profit from the sale. Margin Fee – The interest that a margin trader needs to pay for the margin he borrowed. Sometimes called the rollover fee.Margin Call – The notification made by your broker when your margin balance goes below the Maintenance Margin Requirement. When they do this, they either liquidate your trade ASAP or tell you to fund your account to offset it.Stop Loss – The price level marker where your margin trade closes your trade, ending it at a price lower than your desired profitable price.Take Profit – The price level marker where your margin closes your trade, ending it at your desired profitable price.or short-sell assets like cryptocurrencies using your own funds and margin.Broker – The entity that lends you money, which becomes your margin.Margin Requirement – The amount of money you need to produce yourself to fund your margin account. In traditional markets, the margin requirement can get as low as 50% of the margin account. Exchanges and Brokers that Offer Margin TradingBitMEX BitMEX is one of the more famous crypto exchanges that offer margin trading. The company was founded by banker Arthur Hayes and two other bankers.Only BTC can be deposited into BitMEX accounts. These Bitcoin deposit funds can be used to buy different cryptocurrencies.They are registered in the Seychelles but they operate in Hong Kong. They are also unregulated in any jurisdiction. Deribit Deribit is one crypto margin trading platform that enables users to trade Bitcoin options aside from Bitcoin futures. Unlike futures, options give only the right but not the obligation to buy or sell an asset during the contract’s lifetime. Deribit is well-known for its transparency, though it is still unregulated like BitMEX. Bluebelt

Bluebelt is a three-platform bundle that includes a margin trading platform. Unlike BitMEX and Deribit, Bluebelt allows local fiat currency deposits instead of BTC deposits, as well as crypto-fiat margin trading.The local fiat currency deposit is possible because Bluebelt has local fiat bank accounts in different countries.Bluebelt offers leverage up to 6.67X as well as crypto CFDs Huobi Global Huobi Global is the trading platform for the Chinese crypto trading giant Huobi’s more advanced traders. Unlike BitMEX and Deribit, Huobi requires KYC information during registration. They offer up to 5x leverage in their margin trade service. The Huobi Global HQ is in Singapore, though they have offices in Hong Kong, Korea, Japan, and the USA. SummaryMargin trading is a good way of maximizing potential profits (and losses) in crypto trading by borrowing funds (margin) from a broker.Though similar to typical forex margin trading, crypto margin trading is more attractive to traders who want to trade short-term to take advantage of crypto’s abrupt price movements.The crypto market is not so liquid and very volatile. Whales dominate the market volume while thinkers and influencers have a strong hand on the massive price swings.Still, smart traders worry little about those factors for they study a lot and think more about creating and implementing better trading strategies. When smart traders look for exchanges, are more concerned with the specifications of the platform, like maximum leverage allowed and rollover fees.Without the proper knowledge, margin trading can be very dangerous. However, once you learn the basic terms and functions, margin trading will start making more sense, just like any other craft. Note: This article is not meant to be a crypto investment advice. There are licensed financial advisors who can do that for you.