8 Apps to Use for Investing for Free This 2019

When talking about investing, some broker commissions and other fees can cost frequent traders and stockholders too much spending each year. But, worry not because we will highlight the eight top apps to use for investing for free this 2019. Get to know them to your benefit.

BluebeltFavorite of the majority of investors and dealers, Bluebelt’s mobile app is top notch, a revolutionary tool for investing. You can utilize it for free for your dealings. You can easily download this useful investing app to gain more profits throughout the cryptosphere. There are increasing numbers of users trying and deciding to use it for good because of ease of access, and it works effectively. Through Bluebelt’s platform, you can conveniently buy and manage your funds through a wide range of fiats and cryptocurrencies.Bluebelt has the cleanest and most comfortable application to utilize than other investing apps out there. Setting up your portfolio for free has never been easier than what Bluebelt’s mobile app can do now. Exclusive offers await you from time to time. Imagine this — you can earn $5 worth of Bitcoin as a welcome bonus. Visit

Bluebelt now so that you won’t miss great opportunities.

M1 Finance Recently, M1 Finance has become popular in the stock market over the last year. Its app offers commission-free investing. Plus, you can invest in automatic deposits, fractional shares, and more.Creating and maintaining various portfolios of stocks and ETFs (Exchange-Traded Funds) are made accessible through its platform. It has been noted that when you opt to do five transactions (ETFs) and let’s say at 20 percent each, all you need to do is invest and M1 Finance will take care of everything for free. You can try their custom stock and ETF portfolio now through their site.

Fidelity InvestmentsInvesting for free means a lot to investors and traders. They usually head on to Fidelity’s website (

https://www.fidelity.com) to create a balanced portfolio as Fidelity Investments provides a plethora of commission-free ETFs. Fidelity Investments has a wide range of features that work well altogether. Through its platform, you can obtain the advantage of having a full service investing broker without charge.With no account maintenance fee, you can start depositing as low as $5, and you continue investing for free. Fidelity Investments offers a much better deal compared with other investing platforms available today. Imagine this — currently, Fidelity Investments has two 0.00 percent expense ratio funds. This means that these reserves don’t charge you any management costs — a genuinely free investing option to take.

TD AmeritradeInterestingly, compared with other investing apps, TD Ameritrade has no minimum and no maintenance charge (IRAs). If you are considering tax loss harvesting on your own, you can try the discount TD Ameritrade. It provides more than 100 commission-free ETFs coming from big companies such as Vanguard, iShares, and many others.Remember this — it’s noteworthy to screen no load ETFs first before you go on with your dealing as TD Ameritrade need to charge for some mutual funds, ETFs, and equity trades. But, overall, TD Ameritrade’s app is a great investing tool, providing you information, research, and portfolio analysis free of charge.You can visit their website now for the app at

https://www.tdameritrade.com/.

RobinhoodAre you looking for a platform that offers 100 percent free stock trades? Look no further as Robinhood’s website (

https://www.robinhood.com/) can provide you this feature. The app that it provides enables you to purchase and vend stocks at a market price free of charge. The Robinhood is unbeatable when it comes to open deals.If you’re an active dealer, you’ll love utilizing the application because the app has lots of functionalities. As a clear user crossing point, the app brings practical research tools for you to gain more profits. The good thing about Robinhood’s app is that it allows you to manage your limit orders and stop loss orders as well conveniently.Robinhood makes money by Robinhood Gold — a margin account that enables users to purchase and sell after hours. The downside of the platform is you can’t purchase fractional shares. But, the majority of serious stakeholders prefer Robinhood’s app because of the advantages that free research tools give them, giving investors a more systematic method for investing.

Vanguard

Photo by Vanguard

You can find another tool to invest for free through Vanguard — a company known for its consistency as a low-cost investment service provider. At Vanguard, there is no charge for the commissions when you purchase and sell Vanguard ETFs.Vanguard offers you to become a Voyager, Voyager Select, Flagship, or Flagship Select Services client, and there’s no account service charge for signing up to get your account documents electronically.The company continues to provide a low-fee index fund line of attack to capitalizing. You can visit its website at

https://investor.vanguard.com/corporate-portal/.

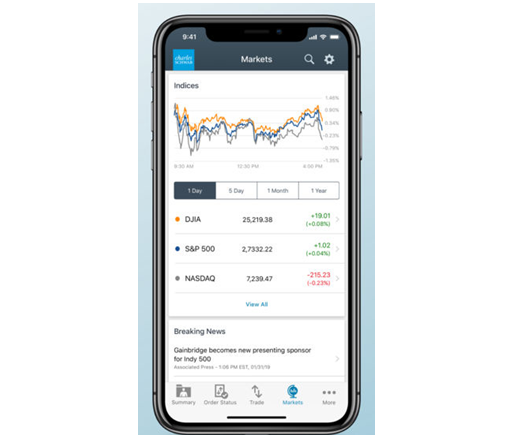

Similar to TD Ameritrade and Fidelity, Charles Schwab can also help you with commission-free ETF trades. Through its app, you can broaden your contact with more than 500 ETFs throughout various asset classes and stock companies online.Charles Schwab offers a more contemporary way to capitalize. But, take note that for almost all account types you can have with Charles Schwab, you must attain an account minimum which is worth $1,000.Charles Schwab’s website is

https://www.schwab.com/.

Wealthfront

Photo by Invest

Considering the best option for college saving? Look no further as Wealthfront offers you a way to utilize the passive investment to build capital. Its app has a smart feature that gives you the advantage to maximize your reserves. Here, you can capitalize based on your risk tolerance.The Wealthfront app is ideal to use because you can invest free of charge for the first $10,000. On top of that, there will only be a minimal fee of 0.25 percent per year. Take note that Wealthfront implements a minimum balance requirement, which is $500.Through Wealthfront, you can invest your currency into up to eleven ETFs, plus the 529 College Savings Plan is available as an added investment option. You can try a free investment plan from Wealthfront at

https://invest.wealthfront.com/.

ConclusionInvestment apps are growing for you to grab the top opportunities in the stock market. Consider the eight apps mentioned above to become the most exceptional performer in the “cryptosphere” this year.